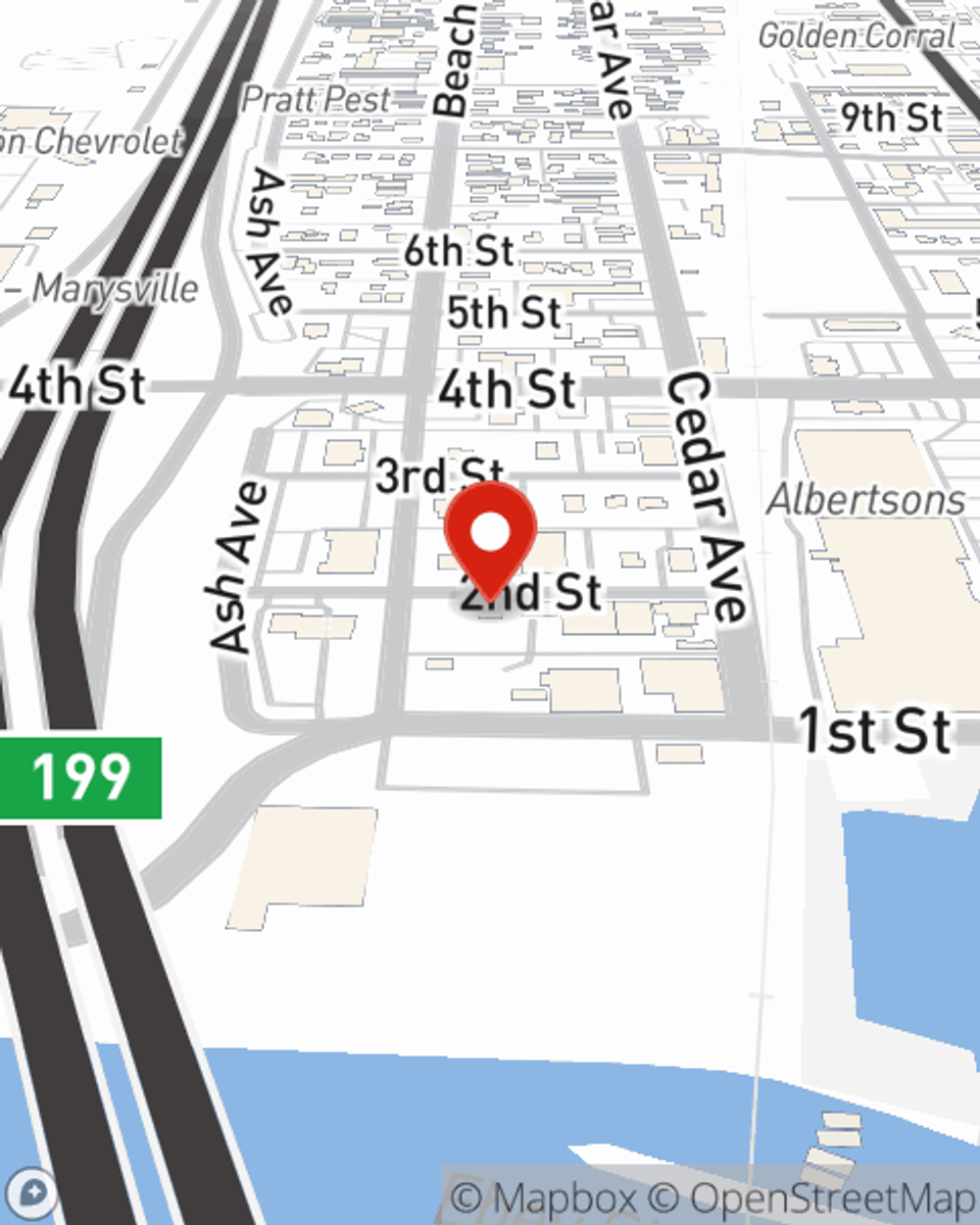

Homeowners Insurance in and around Marysville

Homeowners of Marysville, State Farm has you covered

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Snohomish County

- North Marysville

- Everett

- Arlington

- Snohomish

- Lake Stevens

- Granite Falls

- King County

- Stanwood

- Bothell

- Idaho

- Oregon

- Washington

- Mill Creek

- Darrington

- Tulalip

- Whidbey Island

- Mukilteo

- Edmonds

- Monroe

Home Sweet Home Starts With State Farm

You want your home to be a place of refuge after a long day. That doesn't happen when you're worrying about your kids coloring on the walls again, and especially if your home isn't insured. That's why you need us at State Farm, so all you have to worry about is the first part.

Homeowners of Marysville, State Farm has you covered

The key to great homeowners insurance.

Safeguard Your Greatest Asset

Julie Kerber will help you feel right at home by getting you set up with great insurance that fits your needs. Protection for your home from State Farm not only covers the structure of your home, but can also protect valuable items like your pictures.

It's always the right move to get coverage with State Farm's homeowners insurance. Then, you won't have to worry about the unpredictable fire damage to your property. Contact Julie Kerber today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Julie at (360) 454-0078 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Julie Kerber

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.